installment open end credit example

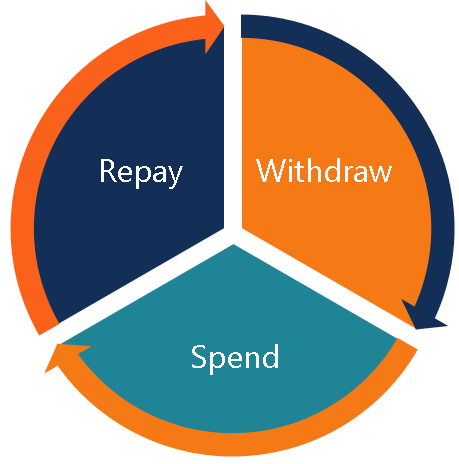

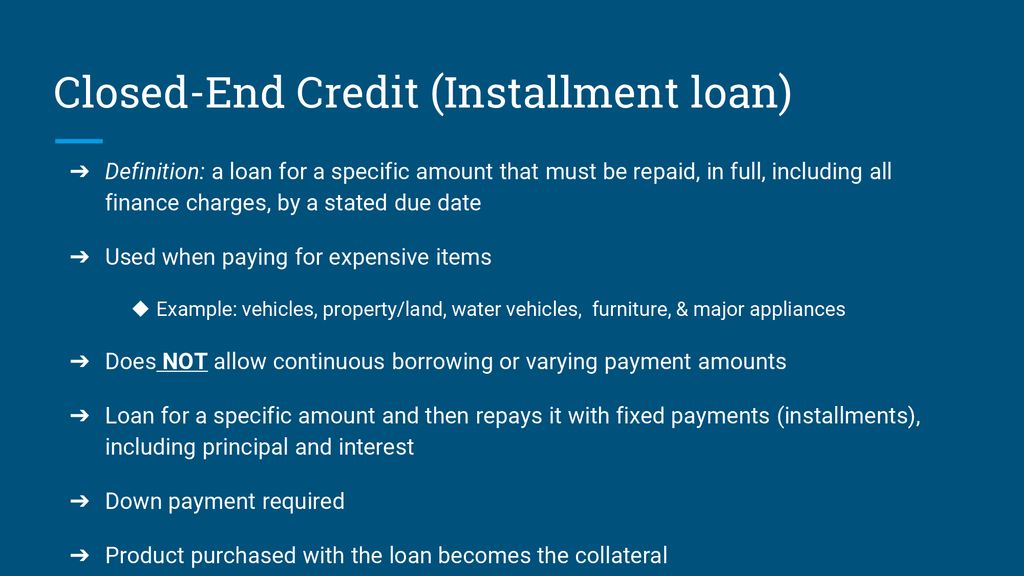

Open end loan can be borrowed multiple times. Installment credit is when you borrow a specific amount of money from a lender and agree to pay off the loan in regular payments of a fixed amount over a specified time period.

Understanding Different Types Of Credit Nextadvisor With Time

The payments to be made will therefore be 30000 plus interest without having to repay the 20000 remaining in the account unless the same is utilized for something.

. Open-End Unsecured An unsecured open-end loan is a line of credit thats not attached to a piece of collateral. D installment loan from a furniture store. As you make the payments the balance of the account lowers.

A Single lump sum of credit B An installment loan for purchasing furniture C A mortgage loan D A department store credit card. Examples of installment loans include auto loans mortgage loans personal loans and student loans. Automobile loan from a credit union.

B the mortgage loan from a savings and loan institution. Most companies that offer open-end credit will check a FICO credit score as part of their underwriting. Home mortgages car loans and student loans are the most common examples of installment credit.

Common examples of revolving-open end. C automobile loan from a credit union. Examples of installment loans include mortgages auto loans student loans and personal loans.

Many financial institutions refer to closed-end credit as an installment loan or a secured loan. What is a open-end loan. Depending on the product you use you might be able to access the funds via check card or electronic transfer.

Click to see full answer. Is a credit card Closed End Credit. What are three examples of installment credit.

D installment loan from a furniture store. The use of a bank credit card to make a purchase. When you purchase an item your available credit decreases.

What is an example of installment credit. T or F A True B False 2 Suppose. The issuing bank.

A good example of an open-end credit is. With an open-end credit the borrower has access to the whole credit limit or full amount once approved. With some forms of open-end credit theres no end date.

Generally real estate and auto loans are closed-end credit but home-equity lines of credit and credit cards are revolving lines of credit or open-end. A student loan is also an example of an installment account. Examples include credit cards home equity loans personal lines of credit and overdraft protection on checking accounts.

A mortgage loan from a savings and loan institution. Installment loan from a furniture store. Which of the following is an example of open-end credit.

An example of an installment loan would be a car loan you are required to pay a set amount of money at a recurring interval ex. A Single lump sum of credit B An installment loan for purchasing furniture C A mortgage loan D A department store credit card E An automobile loan. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University.

Installment loan for purchasing a major appliance. Some dont accrue interest unless a principal balance is still on the loan after a billing period. When you carry a balance from month to month the interest.

In some cases you might be able to accomplish your goals best with a revolving credit line. For instance a lender approves a 50000 line of credit and the borrower withdraws 30000. Click to see full answer.

Common examples of open-end credit are credit cards and lines of credit. Unlike an installment credit account a revolving credit account lets you carry a balance from month to month. B the mortgage loan from a savings and loan institution.

View the full answer. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods. Common examples of installment accounts include mortgage loans home equity loans and car loans.

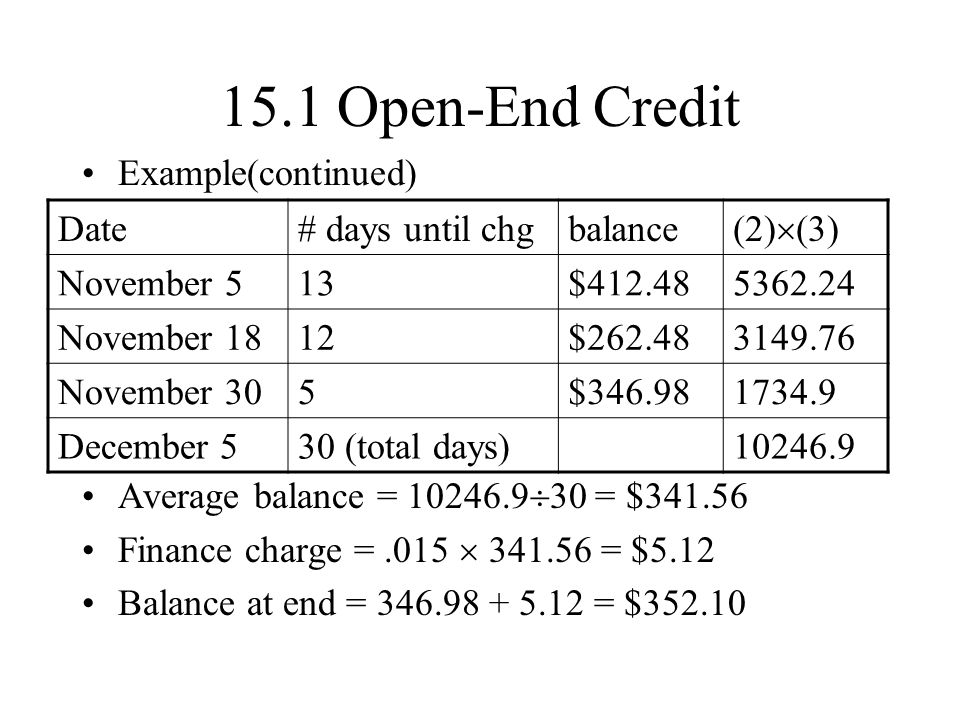

C automobile loan from a credit union. The amount of the loan is 5000. Open End Credit This is a type of credit loan paid on installments in.

There is a 12 simple interest rate and a term of 2 years. E installment loan for purchasing a major appliance. 280 per month until the loan is paid off in full.

The date of the transaction is expected to be April 15 1981 with the first payment due on June 1 1981. A typical car loan checks all of the boxes of. Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments.

Other examples include mortgages Mortgage A mortgage. A good example of an open-end credit is A the use of a bank credit card to make a purchase. The first payment amount is labeled as an estimate since the transaction date is uncertain.

Examples of open-end loans are credit cards and a home equity line of credit or HELOC. E installment loan for purchasing a major appliance. The advantages of installment loans include flexible terms and lower interest rates.

An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans. They do this to determine approval and credit limits. Credit cards and home equity lines of credit are examples of revolving accounts.

Credit cards are an example of revolving open-end credit. This sample illustrates an installment loan. Some examples of open-end credit loans are credit cards home equity lines of credit HELOC and a personal line of credit.

Installment Loans and Open-End Credit Mindie Hunsaker is thinking about buying a car and getting a 3-year loan from her bank in the amount of 7200. When you make payments youll be able to reuse the same credit. Her monthly payment will be 200 7200 36 200.

As you repay what youve borrowed you can draw from the credit line again and again. An example of conventiona. But closed end credit is for a stipulated time with a specific interest rate and charges.

A good example of an open-end credit is A the use of a bank credit card to make a purchase. On a revolving credit account you decide how much to charge every month and how much to repay. Credit cards and credit lines are examples of revolving credit.

The disadvantages of installment loans include the risk of default and loss of collateral.

Types Of Credit Definitions Examples Questions

What Are Three Types Of Consumer Credit

Lesson 16 2 Types Sources Of Credit Ppt Download

Consumer Credit Regulation Nclc Digital Library

What Is Non Installment Credit Lisbdnet Com

What Is Non Installment Credit Lisbdnet Com

Lesson 16 2 Types Sources Of Credit Ppt Download

What Are Three Types Of Consumer Credit

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

What Is Open End Credit Experian

5 Benefits Of Open Banking For Consumers Belvo

Math In Our World Section 8 4 Installment Buying Ppt Video Online Download

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

![]()

What Types Of Loans Are There Student Loan Hero

How To Read Your Credit Card Statement Rbc Royal Bank

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)